Plan 12-30-22: Squeezing and How to Read Pullbacks Intraday

2022 is almost a wrap

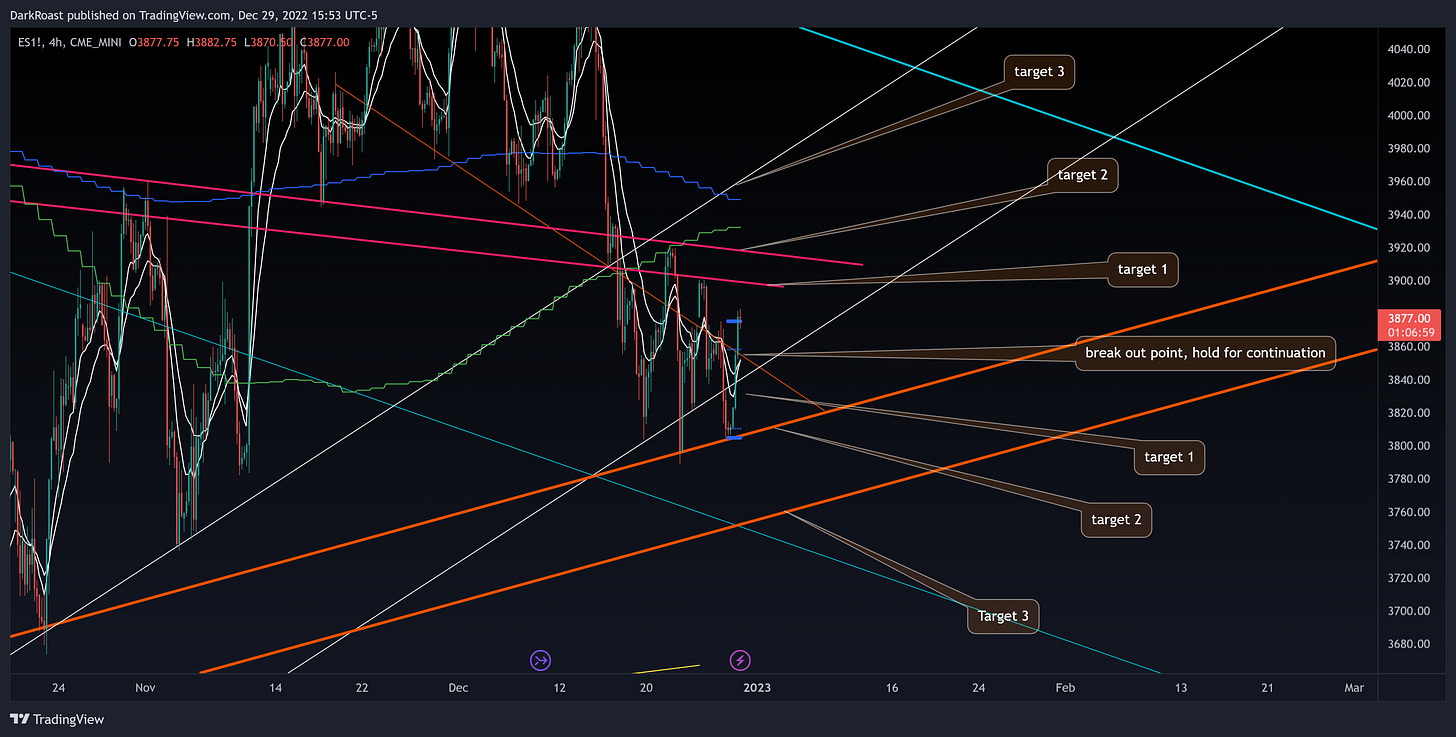

The focus of the stack is how to react to price setups rather than to predict the market’s direction. The preferred pattern traded in any scenario is a failed breakout or key level reclaim.

Daily I’ll explain the overall context for the price action of /ES. My given levels take into account channels, volume profile points of control, key zones acting as either magnets or potential squeeze targets and levels of overhead supply/demand. This information is then distilled down into simple actionable intraday horizontal support and resistance levels. These levels will change each day as price reacts to the various highlighted zones discussed.

For additional questions regarding topics reach out on Twitter @Efficientenzyme

/ES Roadmap:

Keep reading with a 7-day free trial

Subscribe to EE’s /ES to keep reading this post and get 7 days of free access to the full post archives.